Variables:

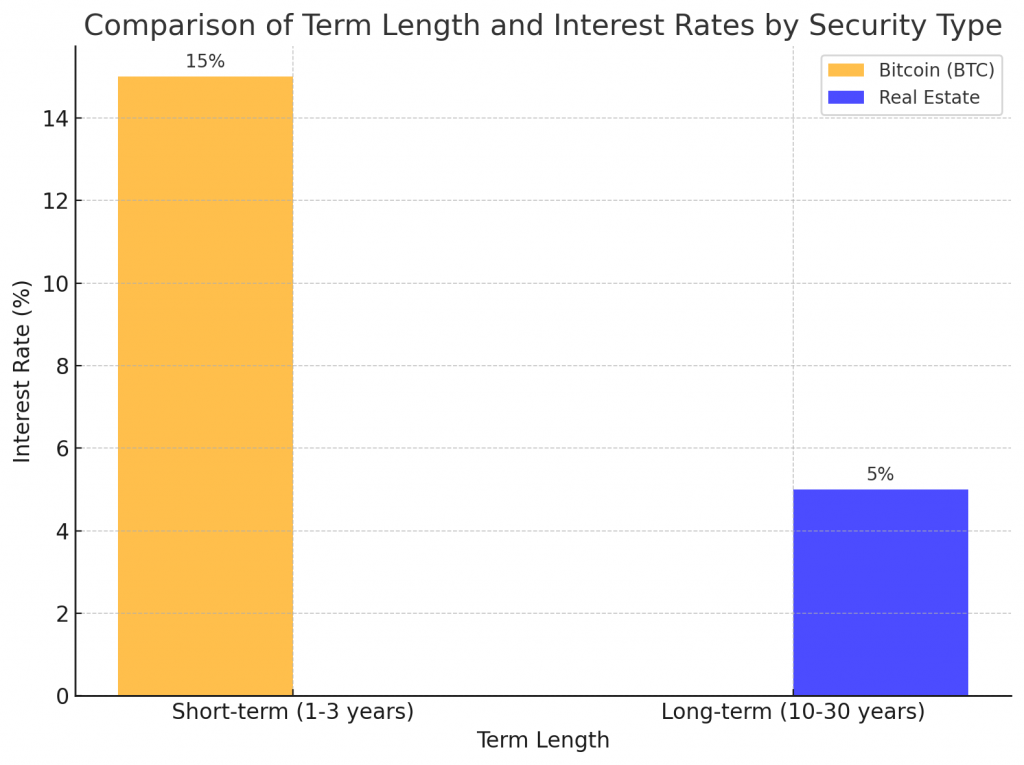

- Security Type: Bitcoin (BTC) vs. Real Estate.

- Term Length: Short-term (1-3 years) vs. Long-term (10-30 years).

- Interest Rate: Typically varies by security and lender risk.

General Trends:

- Bitcoin as security:

- Higher interest rates (10-20% annualized) due to volatility.

- Shorter terms (1-3 years).

- Real Estate as security:

- Lower interest rates (3-7% annualized) due to stability.

- Longer terms (10-30 years).

Let me create a chart for this comparison.

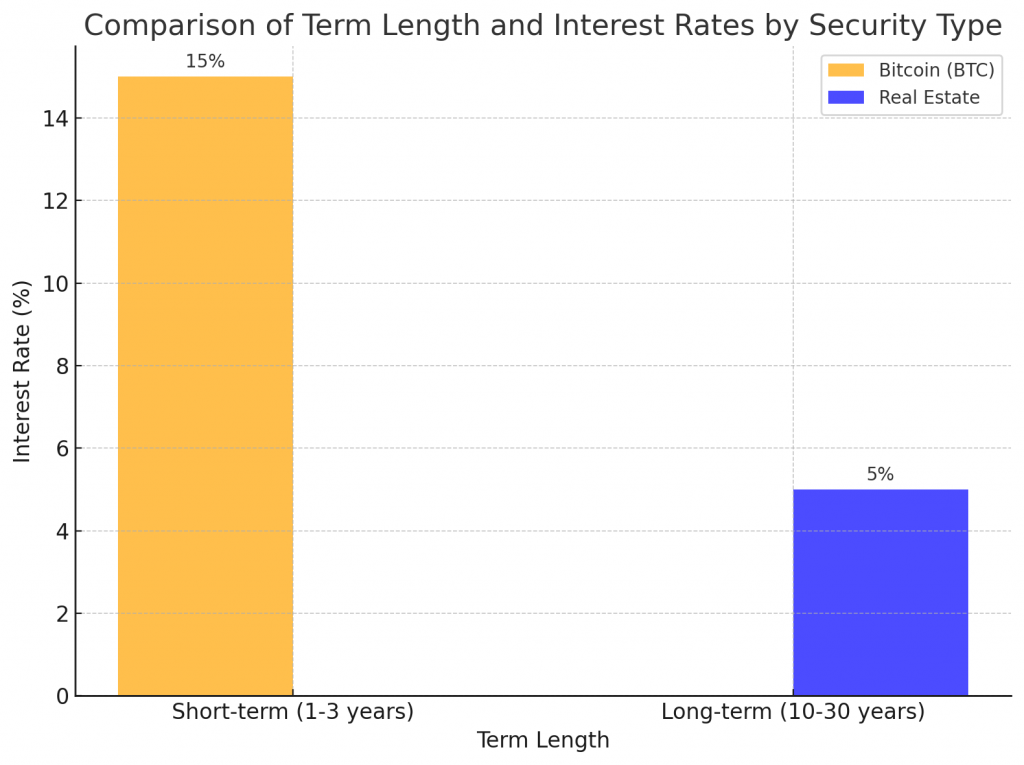

Here is a bar chart comparing interest rates for loans secured by Bitcoin (BTC) and real estate based on term lengths:

- Bitcoin (BTC): High interest rates (~15%) but only available for short-term loans (1-3 years).

- Real Estate: Lower interest rates (~5%) typically tied to long-term loans (10-30 years).

The cost of using Bitcoin for purchases at a retailer in the U.S. depends on several factors, including transaction fees, exchange rates, and any additional costs the retailer might impose for accepting Bitcoin. Here’s a breakdown:

1. Bitcoin Network Transaction Fees:

- Average Cost: $1 to $5 during normal network activity but can rise to $20 or more during congestion.

- Why It Varies: Bitcoin transaction fees are determined by network demand and the size of the transaction (in bytes). High-priority transactions require higher fees.

2. Exchange Rate Volatility:

- Retailers typically rely on payment processors (e.g., BitPay, Coinbase Commerce) to convert Bitcoin to USD instantly.

- The exchange rate is locked during the transaction, but rapid price changes can slightly impact the effective cost.

3. Additional Costs:

- Merchant Processing Fees: Some payment processors charge merchants a small fee (e.g., 1%), which might be indirectly passed on to customers.

- Wallet Costs: If you use a custodial wallet, there may be additional withdrawal or transfer fees.

Example:

- Purchasing a $100 item with Bitcoin:

- Transaction Fee: ~$2 (if the network is uncongested).

- Total Cost in BTC: $102 worth of Bitcoin at the current exchange rate.

Tips for Minimizing Costs:

- Use the Bitcoin Lightning Network where supported, which has negligible fees.

- Check network activity to avoid peak times.

- Choose a retailer that directly supports Bitcoin to avoid intermediary fees.

The cost of purchasing U.S. dollars with Bitcoin depends on several factors, including the exchange rate, transaction fees, and the platform you use. Here’s a breakdown:

1. Exchange Rate

- Market Rate: The USD/BTC rate fluctuates based on global supply and demand.

- Most exchanges offer rates close to the market price, but there might be a small spread (difference between the buying and selling price), typically 0.1%-1%.

2. Platform/Exchange Fees

Different platforms charge fees for converting Bitcoin to USD:

- Centralized Exchanges (e.g., Coinbase, Binance, Kraken):

- Fee Range: 0.1%-1.5% of the transaction amount.

- Example: Selling $1,000 worth of Bitcoin may cost $1 to $15 in fees.

- Peer-to-Peer Platforms (e.g., Paxful, LocalBitcoins):

- Fee Range: Typically lower for sellers, but you may face a larger spread or negotiation margins.

3. Bitcoin Network Fees

- When transferring Bitcoin to the exchange, you pay a network transaction fee.

- Average Fee: $1 to $5, but can rise during congestion.

4. Bank Withdrawal or Processing Fees

If you withdraw USD to a bank account:

- Fee Range: $0 to $25, depending on the platform and withdrawal method.

Create a chart showing the costs

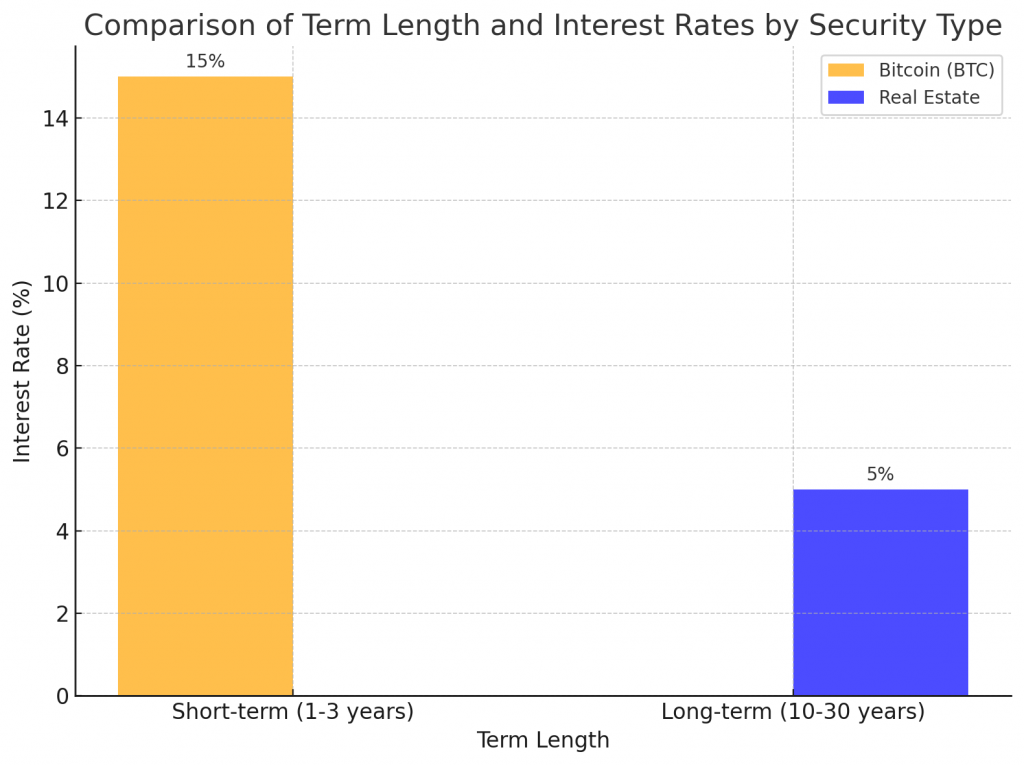

Creating a chart comparing term length and interest rates for loans secured by Bitcoin (BTC) or real estate involves generalizing trends based on industry norms. Here’s an outline:

Variables:

- Security Type: Bitcoin (BTC) vs. Real Estate.

- Term Length: Short-term (1-3 years) vs. Long-term (10-30 years).

- Interest Rate: Typically varies by security and lender risk.

General Trends:

- Bitcoin as security:

- Higher interest rates (10-20% annualized) due to volatility.

- Shorter terms (1-3 years).

- Real Estate as security:

- Lower interest rates (3-7% annualized) due to stability.

- Longer terms (10-30 years).

Let me create a chart for this comparison.

Here is a bar chart comparing interest rates for loans secured by Bitcoin (BTC) and real estate based on term lengths:

- Bitcoin (BTC): High interest rates (~15%) but only available for short-term loans (1-3 years).

- Real Estate: Lower interest rates (~5%) typically tied to long-term loans (10-30 years).

This highlights the difference in risk and stability associated with each type of collateral.

The cost of using Bitcoin for purchases at a retailer in the U.S. depends on several factors, including transaction fees, exchange rates, and any additional costs the retailer might impose for accepting Bitcoin. Here’s a breakdown:

1. Bitcoin Network Transaction Fees:

- Average Cost: $1 to $5 during normal network activity but can rise to $20 or more during congestion.

- Why It Varies: Bitcoin transaction fees are determined by network demand and the size of the transaction (in bytes). High-priority transactions require higher fees.

2. Exchange Rate Volatility:

- Retailers typically rely on payment processors (e.g., BitPay, Coinbase Commerce) to convert Bitcoin to USD instantly.

- The exchange rate is locked during the transaction, but rapid price changes can slightly impact the effective cost.

3. Additional Costs:

- Merchant Processing Fees: Some payment processors charge merchants a small fee (e.g., 1%), which might be indirectly passed on to customers.

- Wallet Costs: If you use a custodial wallet, there may be additional withdrawal or transfer fees.

Example:

- Purchasing a $100 item with Bitcoin:

- Transaction Fee: ~$2 (if the network is uncongested).

- Total Cost in BTC: $102 worth of Bitcoin at the current exchange rate.

Tips for Minimizing Costs:

- Use the Bitcoin Lightning Network where supported, which has negligible fees.

- Check network activity to avoid peak times.

- Choose a retailer that directly supports Bitcoin to avoid intermediary fees.

Would you like a detailed example or current fee data?

The cost of purchasing U.S. dollars with Bitcoin depends on several factors, including the exchange rate, transaction fees, and the platform you use. Here’s a breakdown:

1. Exchange Rate

- Market Rate: The USD/BTC rate fluctuates based on global supply and demand.

- Most exchanges offer rates close to the market price, but there might be a small spread (difference between the buying and selling price), typically 0.1%-1%.

2. Platform/Exchange Fees

Different platforms charge fees for converting Bitcoin to USD:

- Centralized Exchanges (e.g., Coinbase, Binance, Kraken):

- Fee Range: 0.1%-1.5% of the transaction amount.

- Example: Selling $1,000 worth of Bitcoin may cost $1 to $15 in fees.

- Peer-to-Peer Platforms (e.g., Paxful, LocalBitcoins):

- Fee Range: Typically lower for sellers, but you may face a larger spread or negotiation margins.

3. Bitcoin Network Fees

- When transferring Bitcoin to the exchange, you pay a network transaction fee.

- Average Fee: $1 to $5, but can rise during congestion.

4. Bank Withdrawal or Processing Fees

If you withdraw USD to a bank account:

- Fee Range: $0 to $25, depending on the platform and withdrawal method.

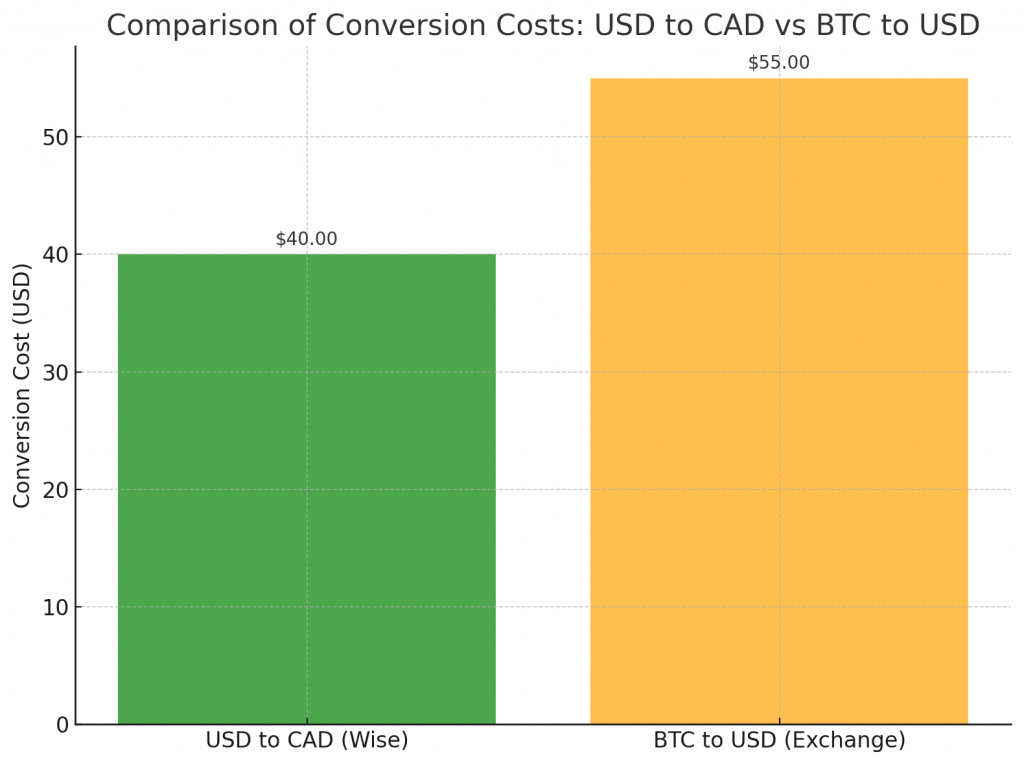

ChatGPT, response to create a chart of the cost to convert 10,000 from usd to cad at wise compared to the cost to convert 10,000 from btc to usd

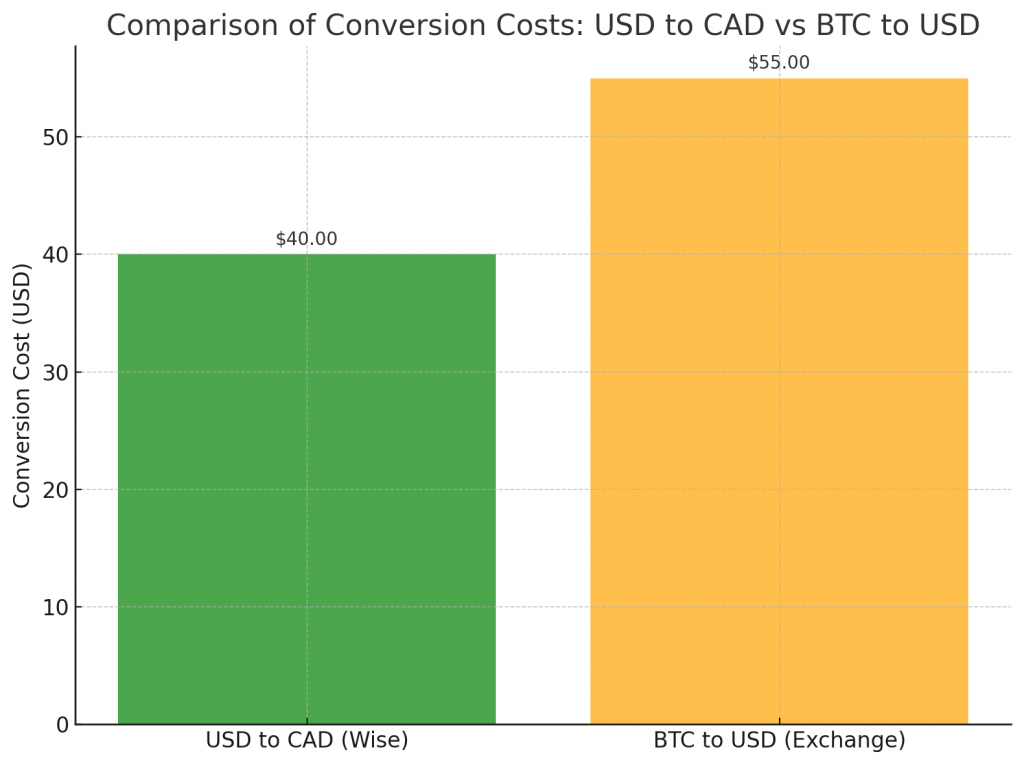

Here is a bar chart comparing the costs of converting $10,000 from:

- USD to CAD using Wise:

- Fee: $40 (0.4%).

- BTC to USD using an exchange:

- Fee: $55 (0.5% exchange fee + $5 network fee).

This shows that Wise is slightly cheaper for fiat currency conversions, while Bitcoin conversions involve higher fees due to exchange and network costs. Let me know if you’d like further details!

4o

Prompt

create a chart of the cost comparing the cost to transfer 10,000 usd from a wise account to your checking account and 10,000 from a bitcoin account to your checking account

ChatGPT Response:

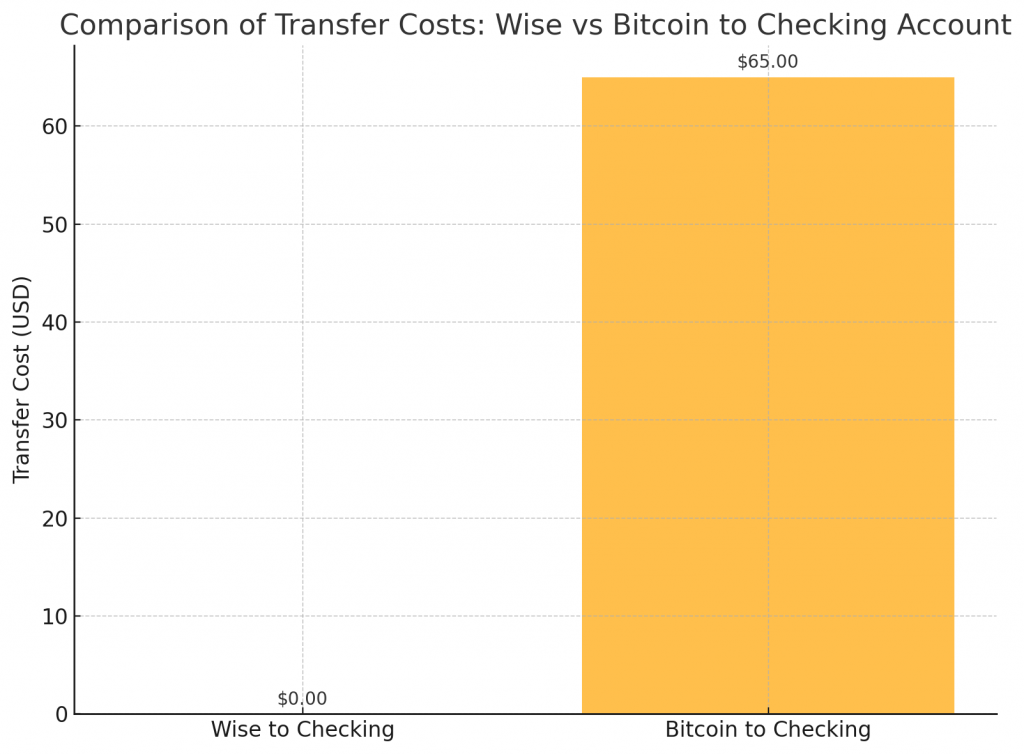

Here is a bar chart comparing the costs of transferring $10,000:

- Wise to Checking Account:

- Cost: $0 (assumes no fee for domestic transfers via Wise).

- Bitcoin to Checking Account:

- Cost: $65 (includes a 0.5% exchange fee, a $5 Bitcoin network fee, and a $10 bank withdrawal fee).

This highlights that Wise offers a more cost-effective option for domestic fiat transfers, while Bitcoin incurs higher costs due to exchange and network fees.

ChatGPT, response to “Create a chart of the cost to convert 10,000 from usd to cad at wise compared to the cost to convert”

Prompt: Create a chart of the cost comparing the cost to transfer 10,000 usd from a wise account to your checking account and 10,000 from a bitcoin account to your checking account

Chat GPT response: Past the chart

The cost of using Bitcoin for purchases at a retailer in the U.S. depends on several factors, including transaction fees, exchange rates, and any additional costs the retailer might impose for accepting Bitcoin. Here’s a breakdown:

1. Bitcoin Network Transaction Fees:

- Average Cost: $1 to $5 during normal network activity but can rise to $20 or more during congestion.

- Why It Varies: Bitcoin transaction fees are determined by network demand and the size of the transaction (in bytes). High-priority transactions require higher fees.

2. Exchange Rate Volatility:

- Retailers typically rely on payment processors (e.g., BitPay, Coinbase Commerce) to convert Bitcoin to USD instantly.

- The exchange rate is locked during the transaction, but rapid price changes can slightly impact the effective cost.

3. Additional Costs:

- Merchant Processing Fees: Some payment processors charge merchants a small fee (e.g., 1%), which might be indirectly passed on to customers.

- Wallet Costs: If you use a custodial wallet, there may be additional withdrawal or transfer fees.

Example:

- Purchasing a $100 item with Bitcoin:

- Transaction Fee: ~$2 (if the network is uncongested).

- Total Cost in BTC: $102 worth of Bitcoin at the current exchange rate.

Tips for Minimizing Costs:

- Use the Bitcoin Lightning Network where supported, which has negligible fees.

- Check network activity to avoid peak times.

- Choose a retailer that directly supports Bitcoin to avoid intermediary fees.

Would you like a detailed example or current fee data?

The cost of purchasing U.S. dollars with Bitcoin depends on several factors, including the exchange rate, transaction fees, and the platform you use. Here’s a breakdown:

1. Exchange Rate

- Market Rate: The USD/BTC rate fluctuates based on global supply and demand.

- Most exchanges offer rates close to the market price, but there might be a small spread (difference between the buying and selling price), typically 0.1%-1%.

2. Platform/Exchange Fees

Different platforms charge fees for converting Bitcoin to USD:

- Centralized Exchanges (e.g., Coinbase, Binance, Kraken):

- Fee Range: 0.1%-1.5% of the transaction amount.

- Example: Selling $1,000 worth of Bitcoin may cost $1 to $15 in fees.

- Peer-to-Peer Platforms (e.g., Paxful, LocalBitcoins):

- Fee Range: Typically lower for sellers, but you may face a larger spread or negotiation margins.

3. Bitcoin Network Fees

- When transferring Bitcoin to the exchange, you pay a network transaction fee.

- Average Fee: $1 to $5, but can rise during congestion.

4. Bank Withdrawal or Processing Fees

If you withdraw USD to a bank account:

- Fee Range: $0 to $25, depending on the platform and withdrawal method.

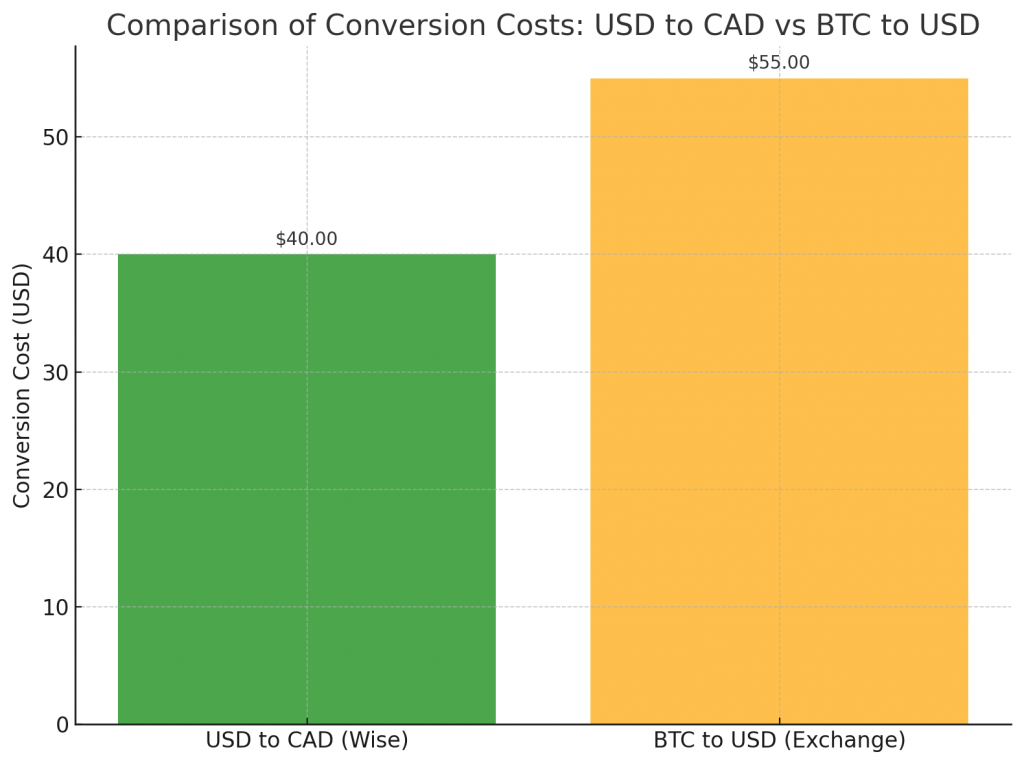

create a chart of the cost to convert 10,000 from usd to cad at wise compared to the cost to convert 10,000 from btc to usd

ChatGPT said:

ChatGPT

Here is a bar chart comparing the costs of converting $10,000 from:

- USD to CAD using Wise:

- Fee: $40 (0.4%).

- BTC to USD using an exchange:

- Fee: $55 (0.5% exchange fee + $5 network fee).

This shows that Wise is slightly cheaper for fiat currency conversions, while Bitcoin conversions involve higher fees due to exchange and network costs. Let me know if you’d like further details!

4o

You said:

create a chart of the cost comparing the cost to transfer 10,000 usd from a wise account to your checking account and 10,000 from a bitcoin account to your checking account

ChatGPT said:

ChatGPT

Here is a bar chart comparing the costs of transferring $10,000:

- Wise to Checking Account:

- Cost: $0 (assumes no fee for domestic transfers via Wise).

- Bitcoin to Checking Account:

- Cost: $65 (includes a 0.5% exchange fee, a $5 Bitcoin network fee, and a $10 bank withdrawal fee).

This highlights that Wise offers a more cost-effective option for domestic fiat transfers, while Bitcoin incurs higher costs due to exchange and network fees. Let me know if you’d like further details or refinements!

Prompt: Create a chart comparing term length and interest rates for loans secured by Bitcoin (BTC) or real estate

Chat GPT Response: See Link

Creating a chart comparing term length and interest rates for loans secured by Bitcoin (BTC) or real estate involves generalizing trends based on industry norms. Here’s an outline:

Variables:

- Security Type: Bitcoin (BTC) vs. Real Estate.

- Term Length: Short-term (1-3 years) vs. Long-term (10-30 years).

- Interest Rate: Typically varies by security and lender risk.

General Trends:

- Bitcoin as security:

- Higher interest rates (10-20% annualized) due to volatility.

- Shorter terms (1-3 years).

- Real Estate as security:

- Lower interest rates (3-7% annualized) due to stability.

- Longer terms (10-30 years).

Let me create a chart for this comparison.

Here is a bar chart comparing interest rates for loans secured by Bitcoin (BTC) and real estate based on term lengths:

- Bitcoin (BTC): High interest rates (~15%) but only available for short-term loans (1-3 years).

- Real Estate: Lower interest rates (~5%) typically tied to long-term loans (10-30 years).